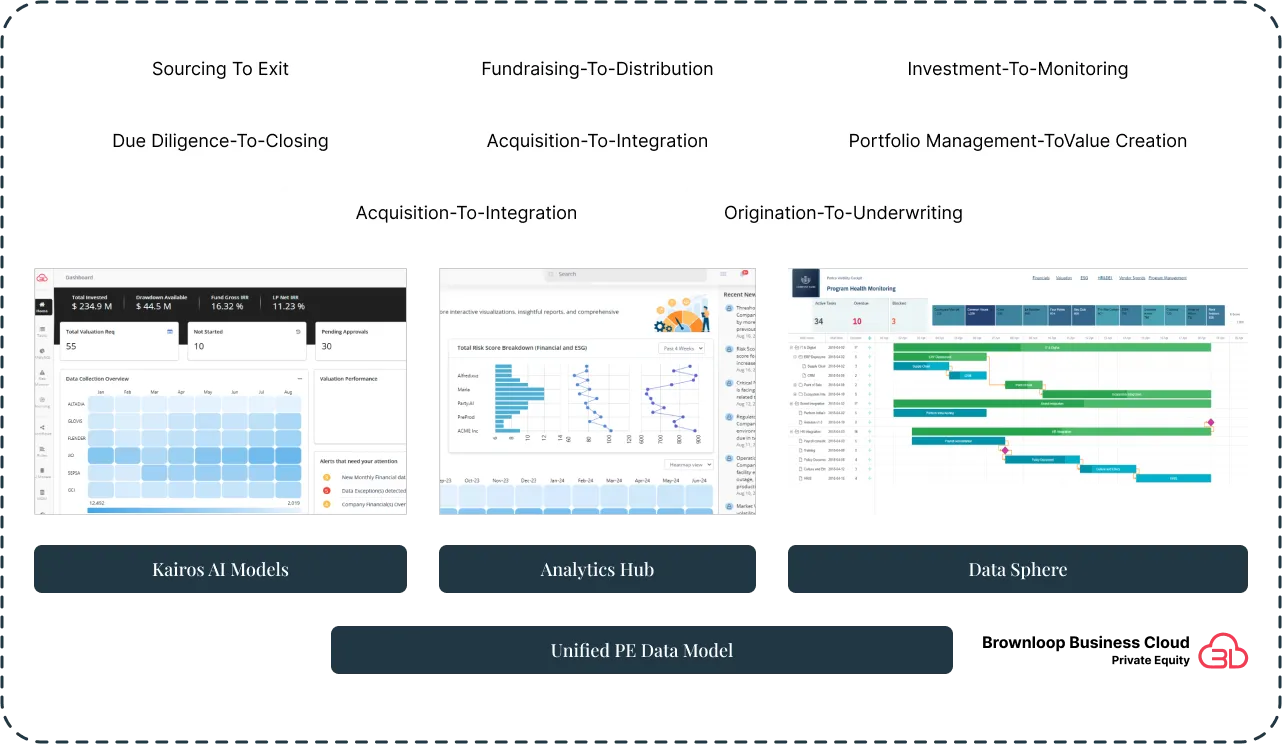

From our flagship AI solution, KAIROS AI, that drives strategic insights, to the comprehensive Analytics Hub hosting bespoke solutions and accelerators, and the power of Data Sphere for seamless data unification — we provide a holistic platform designed to enhance decision-making, streamline operations, and maximize returns.

All enterprise and portco data safe, secure, and accessible for users in a single environment

All data seamlessly connected on one platform for better insights, faster decisions, smarter investments

Brownloop Cloud is compatible with any infrastructure platform of your choosing

Get the best-in-class Advanced Analytics and AI models for Private Equity with Brownloop Business Cloud

The most advanced AI in Private Equity.

100% private equity trained and the gold standard for Tier 1 private equity firms.

Cutting-edge Private Equity analytics tools driving better insights, faster decisions, smarter investments.

All enterprise and portfolio company data seamlessly integrated in a single secure environment.

Our platform offers unprecedented transparency, enabling investors to monitor fund performance and portfolio companies in real time, providing a clear, data-driven view of returns and risks.

We deliver a competitive edge across the entire investment lifecycle — from deal sourcing and due diligence to post-deal synergy tracking. By leveraging our robust, searchable repository of data from past deals, GPs can access valuable insights to make informed decisions and optimize strategies.

Our solutions drive value creation by offering deep performance analysis and real-time data visibility, enabling management teams to track progress, benchmark against peers, and pinpoint areas for improvement to accelerate growth.

Our tools are fostering new ways of deal sourcing and scouting, efficiency in due diligence process to enable quicker and smarter decisions, benchmarking companies to industry standards and seamless post deal integration and synergy tracking.

Quickly transforms a 50 – 100 page Confidential Information Memorandum (CIM) into a concise summary within minutes. Our tool is tailored to incorporate your specific fields, present the information in your preferred format, and assign a score based on your investment criteria.

Streamlines the creation of investment memos by leveraging your inputs and secondary research, tailored for Investment Committee presentations.

Our AI models can evaluate the risks associated with a target by identifying patterns in market data, financial stability, and company-specific risks. It can identify potential red flags, like high levels of debt or operational inefficiencies.

Gathers comprehensive information on companies, sectors, and more, while also offering a knowledge graph for enhanced insights and data visualization.

Analyzes market trends, customer base, competitive landscape, and potential for future growth.

Use our AI tool to analyze vast amounts of due diligence documents received in VDIs (e.g., legal contracts, IP agreements, financial reports) by extracting key data points, identifying inconsistencies, and flagging potential issues or risks.

Use our valuation app to develop comprehensive valuation models and reports, adding structure to valuation process.

Our AI tool can simulate different deal structures (e.g., debt vs. equity financing, earn-outs) and analyze the potential financial outcomes, providing insights into how each option impacts the return on investment

We provide customized automated solutions to build term sheets using our AI tool

Monitor the integration process between portfolio companies using our specialized integration solutions

Our tool analyzes and tags vendors across portfolio companies, consolidating spend data to provide PE firms with a comprehensive view. This enables negotiating better rates for products and services, leveraging economies of scale for cost optimization

A custom-built tool for real-time analysis of synergy realization, identifying any gaps to ensure maximum value capture

Leverage our AI and data analytics solutions for real-time evaluation of the performance of portfolio companies against KPIs, financial benchmarks, and operational goals, ensuring that value creation efforts are on track.

Our app uses machine learning models that can simulate various exit scenarios (e.g., IPO vs. sale) and analyze the financial implications of each option, allowing the PE firm to choose the best exit route.

Use our AI-powered tools to automate the creation of periodic reports for Limited Partners (LPs), such as quarterly and annual updates.

LPs can use our AI-powered dashboards which will provide them with real-time, self-service access to performance data, allowing them to track key metrics, view investment updates, and access reports on demand.